By Abubakar Yunusa

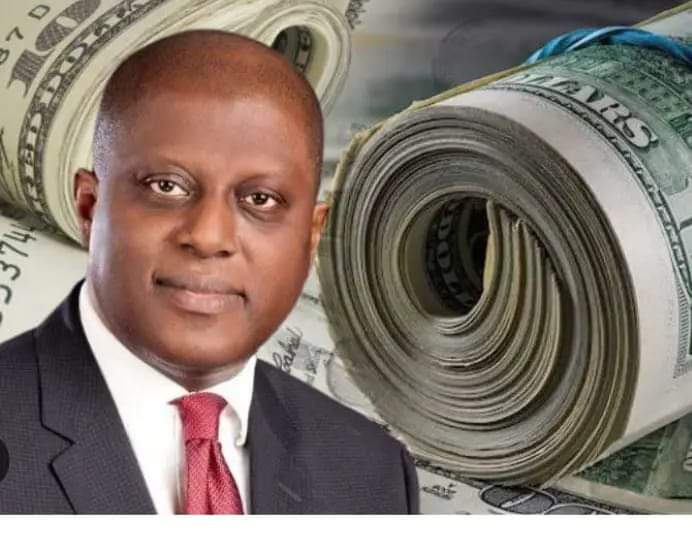

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, stated that the primary goals of Nigeria’s Medium-Term Debt Strategy (MTDS) are to ensure that borrowing activities are conducted within sustainable levels, optimize the debt portfolio for cost and risk, and improve debt management capabilities.

Cardoso made these remarks at the opening ceremony of the World Bank, IMF, WAIFEM regional training on Medium-Term Debt Strategy (MTDS) organized by the World Bank, International Monetary Fund, and WAIFEM in Abuja yesterday.

Representing Cardoso, CBN Director of the Monetary Policy Department, Dr. Muhammed Musa Tumala, said the strategy aims to diversify funding sources through domestic and international borrowings, including issuing sovereign bonds.

According to him, it focuses on extending debt maturities from 10 to 30 years in domestic and international markets to lower refinancing risks and pressure on domestic markets.

He added that MTDS also seeks to sustain debt by considering economic growth, revenue capabilities, and exchange rate fluctuations.

“This strategy is notably the most cost-effective among the three options, primarily due to its reduced reliance on external borrowing, which lowers exposure to currency risk.

“While significant progress has been made in implementing the strategy, ongoing challenges related to exchange rate volatility, inadequate revenue generation, and external shocks, such as oil price volatility, would necessitate continuous refining of the MTDS to address these challenges and leveraging opportunities.

Nigeria is currently assessed to be at a “moderate” overall risk of sovereign stress. This assessment is crucial in understanding the effectiveness and challenges of Nigeria’s MTDS.

“Nigeria’s situation is stable despite the near-term risks attributed to unfavorable global market conditions and the increased debt burden since the pandemic. Significantly, the external debt-to-GDP ratio is a manageable 9%, indicating cautious external borrowing.

“Most (85%) of its debt has medium to long-term maturities, and compared to the emerging and developing economies’ average of 50% GDP, Nigeria’s debt level at 37% GDP shows it’s in a relatively favorable position regarding debt sustainability.

In his welcome remarks, the Director-General of the West African Institute of Financial and Economic Management (WAIFEM), Dr. Baba Y. Musa, said, “We aim to strengthen country teams responsible for developing, updating, and implementing the Debt Management Strategy (DMS).

According to him, participants will be trained in the steps needed to prepare a domestic debt strategy document and other approval and reporting requirements.

Effective debt management strategies ensure a country’s borrowing is sustainable and supports its development objectives.

Musa noted that the plan must balance the need for financing against the costs and risks associated with borrowing options, including the risk of default and the potential for debt distress.

“We cannot overstate the importance of a Debt Management Strategy (DMS). First, it places debt management within the larger macroeconomic framework, ensuring effective coordination with monetary and fiscal policies over the medium-term horizon (3-5 years).

“Second, by carefully strategizing their borrowing requirements and options, countries can achieve their debt management objectives of minimizing borrowing costs and mitigating the risks associated with market instability.

“Additionally, they enhance the credibility of debt management, promote debt transparency, strengthen domestic securities markets, monitor strategy execution and issuance plans, and facilitate constructive discussions with development partners, investors, and credit rating agencies on borrowing strategy choices.

“Therefore, this training aims to enhance participants’ knowledge and skills in designing and implementing the medium-term debt strategy.

“It will cover the entire gamut of the MTDS Framework and the MTDS Analytical Tool, including the required market inputs (primary deficit and gross financing needs, interest and exchange rates, and financing strategies) and defining and calculating the cost-risk indicators.”